- The Dodo Club Newsletter

- Posts

- The Dodo Club (48th Edition) - Making Good Money - Introduction (and Art)

The Dodo Club (48th Edition) - Making Good Money - Introduction (and Art)

5 Considerations

A note from me

Hi Folks, It is now late July and our plans for summer are even more up in the air than when the previous Newsletter was published! At that time, I noted that we haven’t yet gone on our planned vacation to France as we need to sort out good residential care arrangements for my mother after her recent fall. Now, on top of that, we need to care for my dear wife, Mary, who shattered her arm in an accident and needed quite an operation to piece it back together. All our doctors have advised us not to stray far from home in case additional interventions are required. So we will stay in The Hague, at least for the next couple of months during the initial healing.

The damage to the arm resulted from a heavy fall in the street, and even has a special name. It is called a “Monteggia Fracture”, involving both of the bones in the forearm. All I know is that Mary has an incredibly high pain tolerance and I’ve never before seen her in such obvious agony.

There were, however, some positives wrapped into an otherwise awful experience. Shoppers in the street ensured no bicycles or other vehicles would accidentally run into Mary while she lay on the ground awaiting an ambulance, others provided shade from the sun, and others brought cold pads to lay on her forehead. Her phone- connected wristwatch sensed her fall and confirmed that with her before automatically calling for an ambulance and notifying me of the situation and where she was. I ran to her from home, and the ambulance arrived within minutes. The paramedics and all the emergency room staff were superb. The “system” worked swiftly, professionally and compassionately again. At their best, people are kind.

This Newsletter continues to build on threads we have explored previously aimed at helping you build a better life for yourself and the people around you despite the current socio-political challenges and disruptions across the world and your own personal challenges. I hope you continue to find these Newsletters valuable and that they help you enrich your own personal or organisational perspectives.

My Bi-Weekly Guide

Making Good Money - Introduction (and Art)

The phrase “making good money” can, of course be interpreted in more ways than one.

In a narrow, and perhaps somewhat cynical, sense it can refer simply to making lots of money. From a broader and more noble perspective, however, there can be greater emphasis on the word “good” and it can refer to the idea of “doing well by doing good”.

This means engaging successfully in commerce through providing products and services that also promote a common good beyond the direct interests of the transaction partners. I am reminded of business examples I’ve personally experienced when a large commercial investment has generated jobs and boosted a community with widespread benefits. For those interested in entertainment, you can also see these positive knock-on effects on a community from the investment in a football club by two wealthy film actors in the documentary television series "Welcome to Wrexham".

The interactions, even tensions, between generating money and behaving well are evident across societies throughout history. I’m sure we all have examples both of where commerce has driven positive use of financial resources and also where money has been abused. The tensions are referenced in the Bible, such as when Paul instructs his pupil Timothy that greed is the root of all kinds of evils but also acknowledges that wealth in and of itself is not evil. Paul asks Timothy to urge people to use their riches as instruments of 'good works' or 'generosity' that benefits everyone in the community.

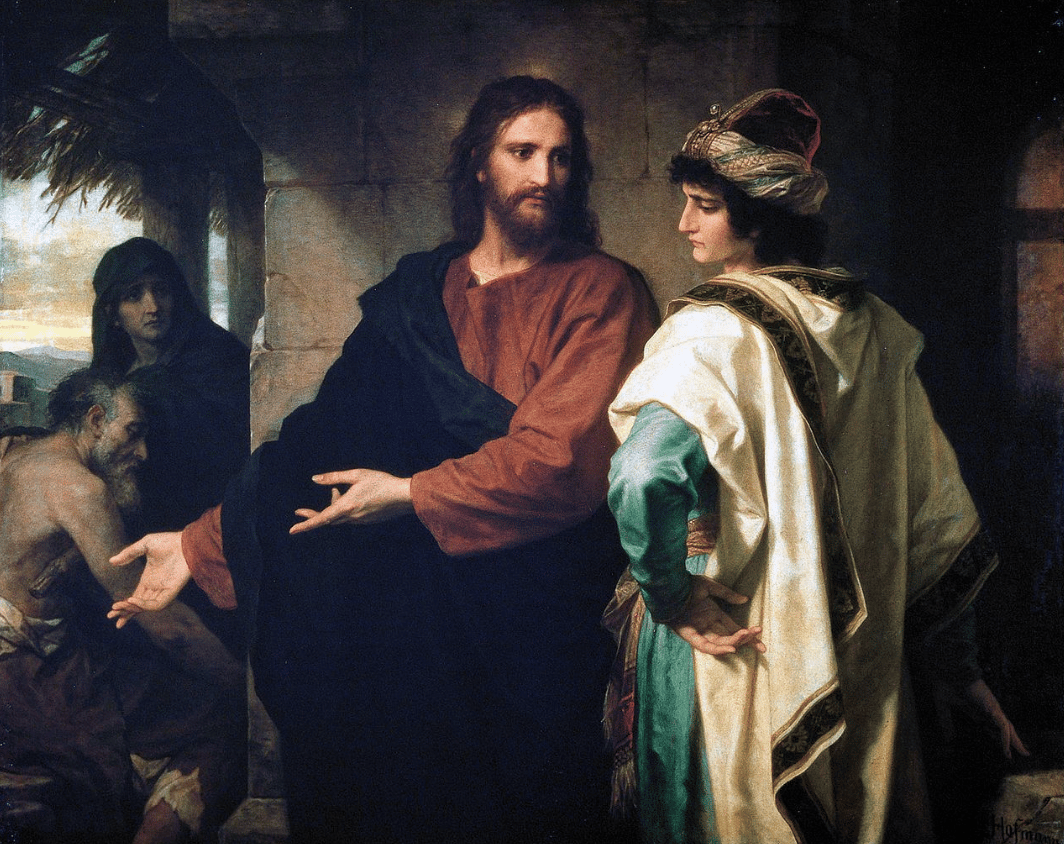

The tensions are also the focus of the biblical parable of the rich young man as illustrated in the following well-known painting by the German artist Heinrich Hofmann, produced in 1889. This can now be found at the Riverside Church in New York.

Contrasts between rich and poor, pleasure and misery, spiritual and worldly are powerfully highlighted in this painting. Hofmann also successfully portrays a mixture of compassion and regret, capturing a sense of the love of Jesus as he invites the young man to sacrifice personal desires, which he, rather reluctantly, declines.

Fortunately, whether your own personal interest in making good money is on the word “money” or on the word “good”, the notions introduced in this Newsletter, and explored more deeply in subsequent Newsletters, are relevant to both.

5 considerations in Making Good Money:

Generating Value:

Whichever the emphasis in your personal interests, the underlying basis for making good money is to “generate value” through the powerful commercial engine. This engine has driven the modern world, building resources and infrastructures that enable billions of people to enjoy a decent material quality of life only available to a few aristocrats in times past. Commercial assets and organisations are financially valued by societies in financial markets, with “Enterprise Value” (EV) being the sum of the value of a company’s shares in equity markets plus the value of its debt.

Of course, valuable resources need to have been invested to build that value, and the value of the financial resources invested can found in the “Capital Employed” (CE) in the accounts. A surplus of Enterprise Value over Capital Employed is a good rough indicator that additional financial value has been generated by the activities of the company, and the ratio of EV/CE (Value Ratio) is a good approximate signal of the effectiveness of this. If this is greater than 1, the company has greater financial value than the capital that has been invested to build it. Value has been generated.

Value Ratio Analysis:

It is informative to break the value ratio into two components – one looking more from present earnings back at what has already been invested to generate these, and one looking more ahead from present earnings towards future possibilities and opportunities.

EV/CE = Earnings/CE x EV/Earnings

The first term is the Return on Capital Employed (ROCE) and indicates the effectiveness of past investments in generating current earnings in the face of competition that would depress earnings. The second is the Price/Earnings (P/E) ratio (at least for a company that is largely equity funded) and reflects the market view of the company’s capabilities and opportunities to significantly grow future earnings in the face of competition.

A high Value Ratio, therefore indicates a combination of good current performance along with high growth opportunities and the market-trusted ability to sustain valuable advantages in the face of competition.

Good Growth:

Which areas present good growth opportunities? We see high growth rates in the deployment of disruptive technologies in a range of areas, which are sustained until saturation effects emerge. Smartphone sales grew explosively from 2010 to 2015. In the energy arena, solar power deployment has seen an average annual growth rate of almost 30% for well over a decade and this is expected to be sustained for the coming decades before saturation effects set in simply because of the scale of the energy system and global economy. This is contributing to decarbonising the global energy system, which is a common good in reducing the greenhouse gas emissions driving climate change.

Once the stars align – technological capability, early demand, policy/infrastructure support – then growth rates can be explosive. We see this currently also in the growth of passenger electric vehicle sales, and in the past in the early growth of the Liquified Natural Gas industry. This is largely driven by competitive dynamics.

Once an early mover demonstrates even the slightest prospect of success, fear of being left behind motivates others to jump in as well. This happens not only in business but also in the accompanying area of government policy as well.

Given that multiple transitions in the energy system are coming (e.g. see Newsletter Edition 17), we can expect multiple areas of explosive growth to emerge and be sustained over decades. This is, therefore, a prime arena for making good money.

The Early Bird:

As highlighted in Section 2 above, however, the anticipated growth rate is just one of the two components necessary for generating substantial financial value. This needs to be underpinned by competitive advantages that can sustain value creation above the cost of capital. Competitive Strongholds need to be built and sustained. An inability to do this is behind the disappointing performance of several companies who have entered the energy transitions arena, in contrast to companies like NextEra Energy and Tesla that still maintain substantial market value. These companies managed to secure competitive advantages through key supply chains, key advanced markets and key policy supports. This has been possible through early actions in advance of competition.

Securing long-term competitive advantage may be possible through being an early mover, but not through being a later follower facing greater competition. The potential regret of investing to be a forerunner may simply be poor returns until take-off actually occurs, while the potential regret of waiting may be foregoing significant long-lasting economic value. In my experience, unfortunately, most investment evaluations used in large companies neglect this perspective. My own evaluations, however, indicate that it would already be economically and commercially shrewd for businesses to invest seriously as pioneers in many areas that are primed to take-off during the timescale of energy transitions (see also Smart Business).

Sweet Spots:

Energy transitions are clearly an arena to explore for sweet spots combining upcoming explosive growth rates and the potential to secure competitive strongholds. Investing in these sweet spots will be an effective route towards “making good money”.

Looking more deeply, while there are any number of supply chains in the global economy, just eight are responsible for over 50% of greenhouse gas emissions. The Food supply chain makes the largest contribution currently, largely because of the land-use changes that the industry generates. After this comes Construction, Fashion, Fast-Moving Consumer Goods (FMCG), Electronics, Automotive manufacturing, Professional Services and (other) Freight. There are potentially multiple sweet spots here with opportunities to generate value by orchestrating premium end-user markets that can channel funds to motivate upstream supply-chain decarbonisation investments with substantial impact.

These are areas to find more ways to make more good money!

Question of The Fortnight

Every fortnight I’ll be asking a thought-provoking question in hopes of sparking interesting and enlightening discussion.

I’d love to hear your response! You can do so by simply responding to this email.

Today’s question is:

What does “Making Good Money” mean to you?

The Dodo Club Online Course

The Dodo Club is Waiting!

The Dodo Club is my online course which has been built for collaboration, learning and mutual support.

In the interest of avoiding the fate of that unfortunate bird, the Dodo, this course aims to help us secure our own personal legacies within scenario planning and the energy transition - and to leave a healthier planet for future generations.

You can access the course through Udemy using the link below!

You can also follow me on LinkedIn where I host webinars, Q&A sessions and provide weekly posts discussing some of the most pressing issues of today.

To be a part of the discussion and to have your voice heard, please do follow along below!